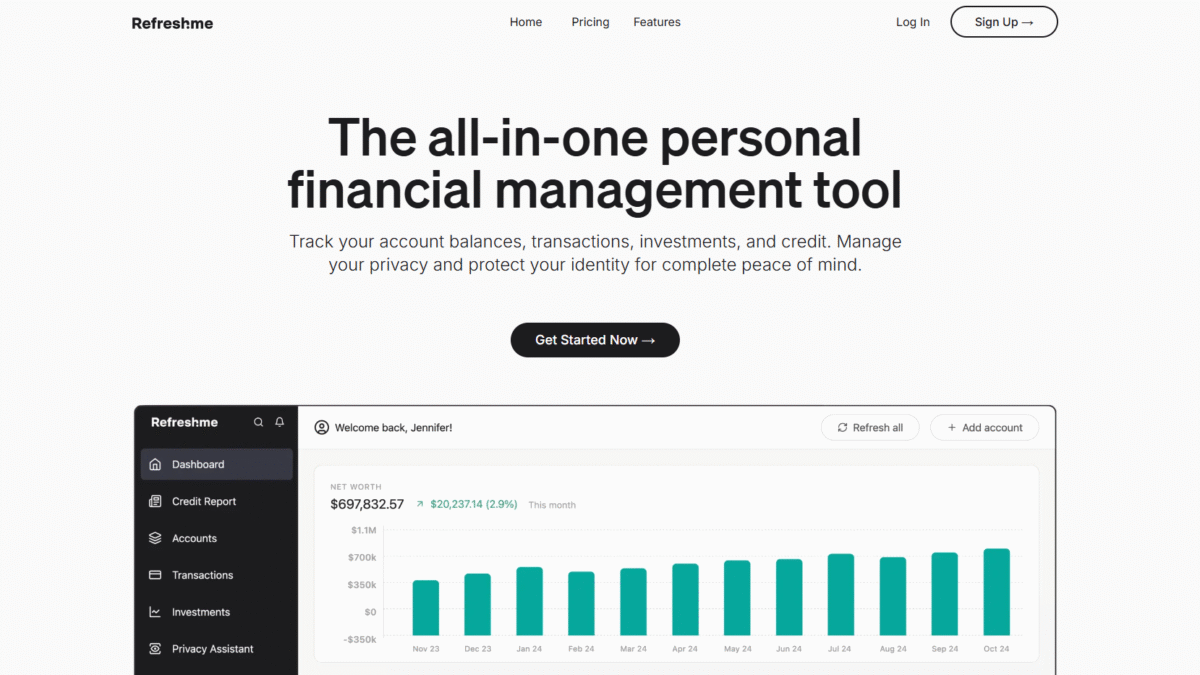

Track Finances & Improve Your Credit Score Easily

Refresh is your powerful personal financial management hub that brings every aspect of your digital finances into one secure place. From tracking your credit score to monitoring spending patterns, investments, and account balances, Refresh delivers the insights you need to take control and make smarter money choices.

What is Refresh?

Refresh is an all-in-one financial wellness platform designed to help you manage your money, monitor your credit, and protect your identity and privacy online. It connects with over 12,000 banks and institutions, consolidates your transactions, balances, and investments, and delivers real-time credit score updates and alerts.

Refresh Overview

Founded with a mission to simplify personal finance, Refresh has rapidly grown into a leading digital money management tool. The company was born out of the founders’ frustration with siloed accounts and confusing credit reports. Since launching, Refresh has:

- Integrated with more than 12,000 financial institutions worldwide.

- Secured $50M in venture funding to expand features and data security.

- Won industry awards for privacy management and identity theft protection.

Today, millions of users rely on Refresh to get a 360° view of their financial health and stay on top of their credit score.

Pros and Cons

Pro: Comprehensive account aggregation—link all your bank, credit card, and investment accounts in one place.

Pro: Real-time credit score and report updates from Equifax, plus three-bureau monitoring.

Pro: Personalized spending alerts to help you stick to budgets and financial goals.

Pro: Robust identity theft protection with $1M insurance and white-glove restoration support.

Pro: Automated privacy management removes your data from thousands of broker sites.

Pro: AI-powered insights that recommend ways to improve your credit and reduce fees.

Con: Annual billing required for deepest discounts (monthly option is higher cost).

Con: No support for some international banks outside the U.S. and Canada.

Features

Refresh delivers an array of features designed to streamline financial management and boost your credit score.

Account Aggregation

Link every checking, savings, credit, and investment account in just a few clicks.

- Over 12,000 supported institutions.

- Instant balance and transaction updates.

- Secure bank-level encryption.

Spending & Budget Alerts

Stay on top of your habits with detailed breakdowns of your transactions.

- Custom spending thresholds.

- Notifications for unusual or overspending patterns.

Investment Tracking

See your entire portfolio at a glance, with historical performance charts and allocation analysis.

- Supports brokerage, retirement, and crypto accounts.

- Asset allocation breakdown.

Credit Report & Score

Get your full Equifax credit report monthly plus daily updates on TransUnion and Experian.

- Track changes to balances, inquiries, and new accounts.

- Actionable tips to boost your score.

Identity Theft Protection

Comprehensive monitoring and restoration support in case of fraud incidents.

- $1M identity theft insurance.

- Dedicated support specialists.

Privacy Management

Automated removal of your personal data from dozens of data-broker sites.

- Monitors for name, address, phone, and email listings.

- Ongoing removal requests.

AI Assistant

Get personalized financial guidance, budgeting tips, and credit recommendations powered by artificial intelligence.

3-Bureau Updates

Receive alerts from Experian, TransUnion, and Equifax on key credit file changes in real time.

Refresh Pricing

Choose the plan that fits your needs and budget. All annual plans include a 40% discount—Get 40% OFF Refresh annual plans Today.

Individual

US$12 per month (billed annually) or US$20 month-to-month.

Ideal for solo users tracking personal spending, credit, and investments.

Couple

US$22 per month (billed annually) or US$35 month-to-month.

Perfect for partners pooling finances and credit monitoring.

Family

US$32 per month (billed annually) or US$65 month-to-month.

Best for households with children or elderly relatives requiring identity protection.

Refresh Is Best For

Whether you’re just starting your financial journey or optimizing a complex portfolio, Refresh adapts to your needs.

Young Professionals

Building credit, managing student loans, and tracking early career savings goals.

Couples & Families

Consolidating accounts, coordinating budgets, and safeguarding identities across multiple members.

Investors

Monitoring stock, retirement, and crypto holdings with detailed performance analytics.

Anyone Concerned About Privacy

Stopping data brokers and protecting personal details from being sold online.

Benefits of Using Refresh

- Unified Financial View: No more juggling apps—see everything in one dashboard.

- Improved Credit Score: Actionable insights and daily monitoring help you climb credit tiers faster.

- Proactive Alerts: Get notified before small issues become big problems.

- Identity Security: Sleep easy knowing your identity is protected by experts and insurance.

- Time Savings: Automated privacy removal and data aggregation free you up for what matters.

Customer Support

Refresh offers responsive, white-glove customer service via email and live chat. Our support team is available weekdays during extended hours and committed to resolving any issues within one business day.

Dedicated identity restoration specialists and financial coaches are on hand to provide guidance whenever you need personalized assistance or have questions about your credit score.

External Reviews and Ratings

Users rave about Refresh’s intuitive interface and the peace of mind from real-time credit monitoring. Many highlight how they found credit errors quickly, disputed them, and saw their credit score rise within weeks. Reviewers also praise the privacy management service for removing personal data from sketchy brokers.

Some customers note the annual billing requirement as a drawback, but most agree the savings outweigh the upfront commitment. Occasional connection issues with smaller banks have been addressed through ongoing API improvements.

Educational Resources and Community

Refresh maintains a robust blog with articles on budgeting, credit improvement, investment strategies, and identity protection tips. Monthly webinars and video tutorials guide users through new features, while a community forum allows members to share success stories and hacks.

Conclusion

Managing your finances, monitoring your credit score, and securing your identity no longer require multiple apps and stress. With Refresh, you gain a comprehensive toolkit that illuminates your full financial picture and empowers you to take charge.

Get 40% OFF Refresh annual plans Today: https://go.investorbullrun.com/refresh