Swing Trading Made Simple: Real-Time Profit Alerts

Searching for the ultimate guide to swing trading? You’ve landed in the right place. I’m here to break down everything you need to know about harnessing short- to intermediate-term market moves—and how The Trading Analyst can transform your results. If you’ve ever entered a trade at the wrong time, watched profits slip away, or felt overwhelmed by conflicting signals, it’s time to Get Started with The Trading Analyst Today and receive real-time profit alerts directly to your phone or inbox.

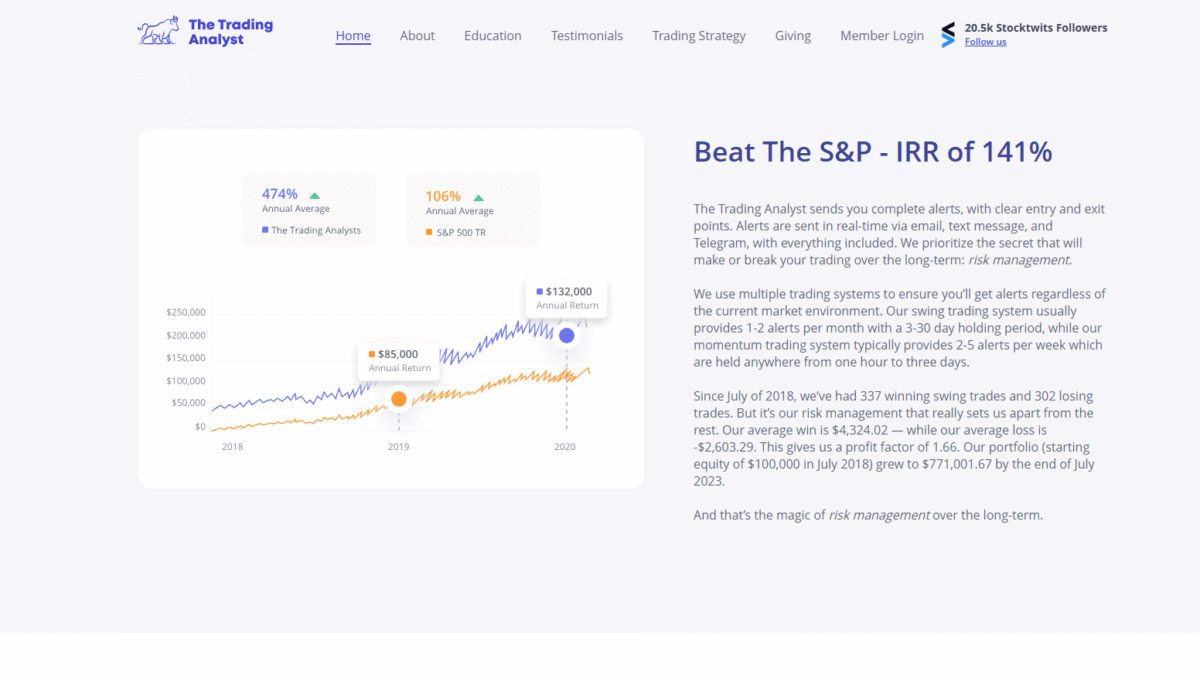

Over the years, I’ve tested countless strategies, tools, and alert services in my quest for consistent gains in swing trading. Few solutions come close to matching the precision, discipline, and performance of The Trading Analyst. With an IRR of 141% since July 2018—blowing past the S&P’s returns—this premium options alert service focuses on what really moves the needle: rigorous risk management and proven entry/exit formulas. In this guide, I’ll walk you through how it works, the features that set it apart, and why it may be the last trading service you ever need.

What is The Trading Analyst?

The Trading Analyst is a subscription-based options trading alert service that delivers instant, easy-to-follow BUY and SELL signals for both swing and momentum trades. Instead of spending hours analyzing charts or deciphering option Greeks, members receive complete trade alerts—strike prices, entry levels, profit targets, and stop-loss parameters—directly via SMS, email, and Telegram. By outsourcing signal generation to a team of veteran traders, you stay focused on execution and risk control.

The Trading Analyst Overview

The Trading Analyst launched in July 2018 when a group of former prop traders and hedge fund analysts united to solve a universal pain point: timing. They saw firsthand how paralyzing indecision and emotional bias could erode returns over time, so they developed systematic screening processes and risk protocols to strip emotion from trading. They coined their core methodology the Volume Confirmation Formula, which they’ve rigorously backtested on tens of thousands of market data points.

Starting with $100,000 in capital, the team applied their formula across multiple systems—swing trading, momentum bursts, and short-term QQQ swings. By July 2023, that portfolio had grown to $771,001.67. Today, The Trading Analyst serves a global community of traders, from full-time professionals to busy executives, enabling them to trade smarter, not harder.

Pros and Cons

Pros:

- Real-time alerts: Instant BUY and SELL signals via SMS, email, and Telegram ensure you never miss a high-probability setup.

- Proven performance: 337 winning swing trades versus 302 losses—a win rate above 53%—and an IRR of 141% since inception.

- Rigorous risk management: Defined stop-losses and position sizing limit drawdowns, with an average loss of $2,603.29 versus an average win of $4,324.02.

- Diverse trading systems: Swing trades, momentum bursts, and QQQ short-term swings allow for consistent alerts across market cycles.

- Clear structure: Each alert includes entry, two profit targets, and a stop-loss level, eliminating guesswork.

- Comprehensive resources: Access to portfolio tracker, swing watchlist, weekly reports, cheat sheets, and on-demand courses.

Cons:

- Timely execution is crucial—delays in placing orders can impact your realized gains.

- Subscription fees may be a barrier for traders with very small account sizes.

- Options trading carries inherent risks that may not suit every investor’s risk tolerance.

Features

The Trading Analyst combines sophisticated data analysis with disciplined execution rules. Here are the standout features:

Volume Confirmation Formula

This proprietary formula is the backbone of every alert. It screens for abnormal volume spikes, open interest shifts, and price pattern confluence to identify stocks likely to make significant moves. Only once all criteria are met does an alert get triggered, dramatically reducing false positives.

Multi-Tier Profit Targets

Each trade comes with two profit targets:

- Target 1: Sell half the position to lock in initial gains.

- Target 2: Sell remaining shares to capture extended momentum.

This approach secures profits while allowing winners more room to run if market conditions remain favorable.

Stop-Loss Discipline

A clearly defined stop-loss accompanies every alert, capping downside risk. This disciplined risk management is a key reason the service has maintained a profit factor of 1.66.

Multiple Trading Systems

The service deploys three complementary systems to keep you active across various environments:

- Swing Trading System: 1–2 alerts per month, holding periods of 3–30 days.

- Momentum Trading System: 2–5 alerts per week, holding positions for 1 hour to 3 days.

- QQQ Short-Term Swings: Quick in-and-out trades focused on the Nasdaq 100 ETF.

Real-Time Multi-Channel Alerts

Whether you’re on the go or at your desk, you’ll receive alerts instantly via your preferred channel—SMS, email, and encrypted Telegram channels—to ensure you can act without delay.

Weekly Market Reports & Watchlists

Each week, members get a detailed report outlining upcoming economic events, earnings releases, and market-moving catalysts. You also gain access to a dynamic swing trading watchlist, highlighting stocks that meet the early screening criteria.

Comprehensive Educational Content

Gain access to beginner and advanced options trading courses, a 42-page chart patterns cheat sheet, and on-demand webinars. Every resource is designed to deepen your understanding of options mechanics, risk management, and technical analysis.

The Trading Analyst Pricing

Choose the plan that best suits your trading style and commitment level:

Monthly Plan

Price: $147/month

Perfect for traders testing the service or who prefer short-term flexibility.

Includes:

- Real-time trade alerts

- Weekly market report

- Access to private Telegram channels

Quarterly Plan

Price: $357/quarter (equivalent to $119/month)

Ideal for active swing traders seeking a discount.

Includes everything in the Monthly Plan, plus:

- Portfolio tracker access

- Swing trading watchlist

Annual Plan

Price: $787/year (equivalent to $65/month)

The best value for serious traders.

Includes all Quarterly Plan features, plus:

- 42-page chart patterns cheat sheet

- Full access to beginner & advanced options courses

- Priority customer support

The Trading Analyst Is Best For

The Trading Analyst is designed to meet the needs of a wide range of traders. Here’s who benefits most:

Busy Professionals

If a full-time job keeps you away from screens, real-time swing trading alerts let you capture market moves on your schedule without constant monitoring.

Self-Directed Investors

DIY investors looking for structured trade entry and exit criteria will appreciate the disciplined, systematic approach—no more guesswork or emotional trading.

Active Day & Swing Traders

Seasoned traders can use the momentum and QQQ systems to complement their existing strategies, increase trade frequency, and diversify across different time frames.

Options Beginners

If you’re new to options but intrigued by their profit potential, the clear alerts and educational courses guide you step by step, reducing the learning curve.

Benefits of Using The Trading Analyst

- Consistent profitability: A 141% IRR since 2018 demonstrates real-world performance.

- Reduced stress: No more FOMO or analysis paralysis—execute clear, data-driven alerts.

- Time efficiency: Spend minutes reviewing alerts instead of hours scanning charts.

- Risk control: Defined stop-losses and position sizing protect your capital.

- Diversified signals: Multiple systems keep you active in any market environment.

- Educational support: Courses, cheat sheets, and webinars help you level up your skills.

- Community access: Engage with fellow traders in private Telegram groups for real-time collaboration.

Customer Support

Support at The Trading Analyst is fast, friendly, and available 24/7. Whether you need help placing an order, clarifying a stop-loss level, or troubleshooting account access, the team responds promptly via live chat, email, or Telegram. They maintain a detailed FAQ database and troubleshooting guides to keep you moving forward without missing alerts.

Many members praise the support team for going the extra mile—whether it’s walking you through your first options order or explaining the logic behind a specific alert. When markets move fast, knowing help is just a message away can make all the difference.

External Reviews and Ratings

Traders on Reddit and TrustPilot consistently rate The Trading Analyst above 4.5 stars. Positive reviews highlight the service’s transparency, detailed performance reports, and the reliability of real-time alerts. One member wrote, “I’ve never felt more confident entering trades because each alert comes with clear risk parameters. My account growth speaks for itself.”

Critics occasionally note that missing an alert window can diminish profits—an issue often solved by setting up multiple notification channels and mastering rapid order entry. Overall, the service’s focus on risk management and systematic rules earns it rave reviews across the trading community.

Educational Resources and Community

Beyond alerts, The Trading Analyst fosters a vibrant learning ecosystem:

- On-demand video courses covering everything from options basics to advanced strategies.

- Weekly live webinars analyzing recent trades, upcoming market events, and Q&A sessions with the founders.

- Daily pre-market briefs highlighting key catalysts and sector movers.

- Exclusive access to private Telegram groups for trade discussions, idea sharing, and peer support.

- Printable 42-page chart patterns cheat sheet for quick reference on common technical setups.

This comprehensive library ensures you’re not just following alerts—you’re learning why each setup meets the criteria and how you can develop your own market intuition over time.

Conclusion

If you’re serious about stepping up your swing trading game, The Trading Analyst offers an unbeatable combination of rigorous screening, disciplined risk management, and real-time multi-channel alerts. With an IRR of 141% since 2018, multiple trading systems, and in-depth educational resources, you’ll gain the confidence and clarity needed to execute high-probability trades. Ready to take control of your trading journey? Get Started with The Trading Analyst Today and say goodbye to guesswork.

Transform your approach to options alerts—minimize losing trades, maximize winners, and reclaim your time. Don’t let another opportunity slip away. Get Started with The Trading Analyst Today.