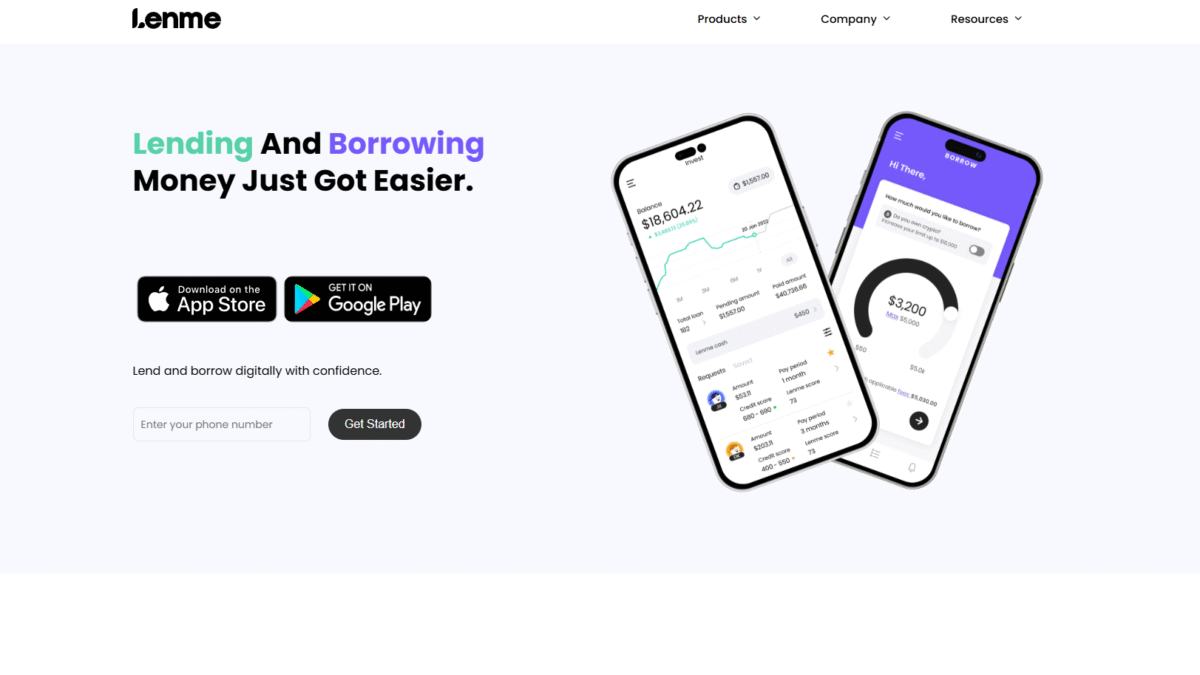

Need Cash Fast? Unlock Instant Loans Up to $5000

What is Lenme?

Lenme is a peer-to-peer lending platform designed to help you access cash fast when you need it most. By connecting borrowers directly with individual and institutional lenders, Lenme streamlines the loan process, reduces overhead costs, and delivers transparent rates. With an easy signup and instant verification, Lenme ensures you can request funds of $50 to $5,000 in minutes. Lenme uses industry-leading credit bureau data to verify your identity, income, and credit score—so you can secure a loan without lengthy delays.

Lenme Overview

Founded to challenge the traditional banking model, Lenme set out to remove the high operational and underwriting costs that have historically prevented borrowers from accessing affordable capital. Utilizing cutting-edge technology and automated underwriting, the platform offers transparent terms, instant funding decisions, and competitive rates regardless of your credit score.

Since its launch, Lenme has grown rapidly, serving thousands of borrowers and lenders. With a mission to democratize access to credit, the company continuously enhances its app features and data analytics, ensuring both parties have the tools needed for a seamless lending experience.

Pros and Cons

Pro: Instant access to funds in as little as minutes, making it ideal when you need cash fast.

Pro: Competitive rates driven by lender competition, often lower than payday loans or credit cards.

Pro: Transparent fee structure—no hidden charges or surprises at repayment.

Pro: Flexible loan amounts ranging from $50 up to $5,000 to suit a variety of needs.

Pro: Inclusive underwriting process—lenders consider more than just credit score.

Pro: Mobile-friendly app that allows you to manage your loan and payments on the go.

Con: Maximum loan capped at $5,000, which may not cover larger expenses.

Con: Interest rates vary based on lender and borrower profile—rates for lower credit scores may be higher.

Features for Getting Cash Fast

Lenme’s feature set is built around speed, transparency, and user empowerment. Every aspect of the platform is optimized to deliver funds quickly while ensuring both borrower and lender have full visibility.

Instant Verification

Lenme integrates with top credit bureaus to instantly verify your personal and financial information.

- Automated income and identity checks

- Real-time credit score retrieval

- Secure data encryption

Competitive Rate Marketplace

Lenders compete to offer you the best rate possible, regardless of credit history.

- Multiple offers to compare

- Transparent APR and fees displayed upfront

- Option to negotiate or select preferred terms

Fast Funding

Once approved, funds can be deposited directly to your bank account in as little as one business day.

- Same-day funding option available

- No manual paperwork or in-person visits

- Notifications track every step of disbursement

Flexible Repayment

Choose a repayment schedule that fits your cash flow and avoid late fees with automatic payments.

- Customizable loan terms

- Auto-debit scheduling

- Early payoff without penalties

Lenme Pricing for Cash Fast Loans

Lenme’s cost structure is straightforward and competitive, reflecting actual risk and eliminating unnecessary overhead.

Standard Plan

Interest Rate: 5%–15% APR

Ideal for small, short-term loans

Highlights:

- No origination fee

- Fast credit decision

- Early repayment allowed

Plus Plan

Interest Rate: 10%–18% APR

Ideal for medium-term loans up to $1,000

Highlights:

- Reduced rates for higher credit scores

- Dedicated customer support line

- Access to promotional rate offers

Premium Plan

Interest Rate: 12%–24% APR

Ideal for larger amounts up to $5,000

Highlights:

- Priority funding

- Extended repayment terms

- Special offers from partner lenders

Lenme Is Best For Cash Fast Borrowers

Whether you’re facing an unexpected bill or looking to bridge a shortfall, Lenme caters to various needs.

Emergency Expenses

Access funds quickly to cover car repairs, medical bills, or urgent home fixes without waiting weeks for traditional loans.

Debt Consolidation

Combine high-interest credit card balances into one manageable payment with a transparent rate.

Small Business Owners

Manage cash flow gaps, inventory purchases, or marketing campaigns with loans up to $5,000.

Benefits of Using Lenme for Cash Fast Needs

Choosing Lenme provides tangible advantages that put you back in control of your finances.

- Speed: Secure funds in as little as one business day.

- Transparency: All rates, fees, and terms are displayed up front.

- Flexibility: Loan amounts from $50 to $5,000 withcustomizable repayment plans.

- Inclusivity: Lenders consider a broad set of data points beyond just credit scores.

- Mobile Access: Manage your loan entirely through the Lenme app, anytime, anywhere.

Customer Support for Cash Fast Assistance

Lenme’s support team is available via live chat and email to answer questions about your loan application, repayment schedule, and account management.

Average response times are under one hour during business days, ensuring you never face delays when troubleshooting or seeking guidance.

External Reviews and Ratings

Users consistently praise Lenme for its quick approval times and clear fee structure. Many highlight the ability to secure emergency funds without resorting to predatory payday loans.

Some borrowers request more rate transparency for lower credit tiers; Lenme addresses this by providing detailed APR breakdowns and proactive notifications when better rates become available.

Educational Resources and Community

Lenme maintains an active blog offering tips on budgeting, credit improvement, and responsible borrowing. Webinars and tutorials guide users through the loan process, while a community forum connects borrowers and investors for peer insights.

Conclusion

When you need cash fast without the hassle of lengthy bank procedures or hidden fees, Lenme stands out as the clear choice. Throughout this guide, we’ve explored how Lenme’s innovative platform, competitive rates, and user-centric features make borrowing up to $5,000 easier than ever. Visit https://go.investorbullrun.com/lenme to secure the funds you need in minutes.