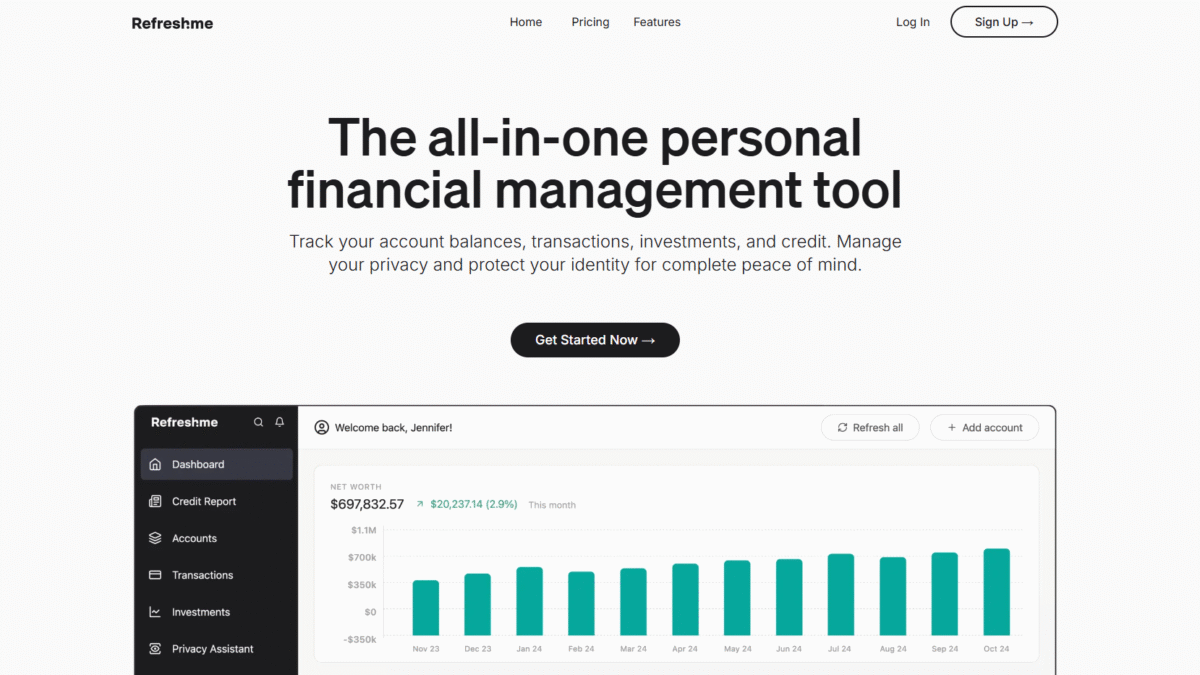

Credit Score Mastery: All-In-One Finance & Privacy

Looking to improve your credit score? You’ve landed in the right spot. With Refresh, you can monitor every aspect of your financial health—from tracking your spending to safeguarding your identity—so you know exactly where you stand at all times.

What is Refresh?

Refresh is an all-in-one personal financial management tool that brings your banking, investments, transactions, and credit into a single dashboard. It provides real-time insights into your credit score, offers daily updates from all three major bureaus, and pairs powerful budgeting tools with robust identity theft protection and privacy management.

Refresh Overview

Founded in 2020 by a team of fintech veterans, Refresh set out to eliminate the fragmentation in personal finance. Early on, the platform secured $30 million in Series A funding and partnered with leading financial institutions to integrate over 12,000 banks and brokerages.

Today, Refresh serves hundreds of thousands of users, helping them maintain healthy spending habits, watch their credit profiles, and stop data brokers from selling their personal details. Its mission: make financial clarity and privacy protection accessible to everyone.

Pros and Cons

Comprehensive Credit Monitoring: Daily 3-bureau updates and monthly credit report pulls from Equifax give you a complete picture of your credit health.

Unified Dashboard: Sync accounts from 12,000+ institutions to see balances, transactions, and investments in one place.

Smart Spending Alerts: Get notified if your spending spikes or if bills and subscriptions change unexpectedly.

Identity Theft Protection: Coverage up to $1 million and white-glove restoration support in case your identity is compromised.

Privacy Management: Automated removal of your personal data from data brokers’ sites, helping you keep your information off the open market.

AI-Powered Insights: A built-in assistant offers personalized guidance on credit optimization, debt payoff, and investment strategies.

Cons: Higher annual pricing compared to basic budgeting apps, limited advanced investment analysis, and some users may find the mobile app interface busy at first.

Features

Refresh combines a suite of powerful features designed to give you financial clarity, credit confidence, and privacy peace of mind.

Sync All Accounts

Aggregate your checking, savings, credit cards, loans, and investment accounts in one secure place.

- Supports 12,000+ banks and brokerages

- Automatic daily balance updates

- Encrypted data transmissions

Spending Insights

Gain visibility into where every dollar goes, with category breakdowns and trend alerts.

- Monthly spending reports

- Custom budget targets

- Alerts for unusual or recurring charges

Investment Tracking

Monitor all your investment holdings—retirement accounts, brokerage, crypto—on one screen.

- Historical performance charts

- Asset allocation overviews

- Dividend and contribution reminders

Credit Report and Score

Access your full credit report and score from Equifax every month and receive daily credit bureau alerts.

- TransUnion, Experian, Equifax updates

- New account, inquiry, and balance change notifications

- Actionable tips to boost your score

Identity Theft Protection

Comprehensive monitoring plus $1 million insurance coverage and dedicated restoration services.

- Dark web scanning

- Identity restoration specialists

- Fraud resolution support

Privacy Management

Automated removal of your personal details from data broker sites, reducing unsolicited outreach.

- Name, address, phone removal requests

- Ongoing monitoring of broker databases

- Weekly privacy status reports

AI Assistant

An intelligent guide that analyzes your financial patterns and suggests steps to improve your credit, save on fees, and maximize returns.

- Customized credit-boost strategies

- Debt-payoff plan outlines

- Investment opportunity highlights

Refresh Pricing

Refresh offers tiered plans for individuals, couples, and families—all including full credit monitoring, identity protection, and privacy management.

Individual

💵 $12 per month (billed annually) or $20 per month (billed monthly). Ideal for solo users who want a complete financial overview.

- All account syncing

- 3-bureau credit updates

- Identity theft protection

- Privacy management

Couple

💵 $22 per month (billed annually) or $35 per month (billed monthly). Perfect for partners sharing finances and credit goals.

- Dual user access

- Combined credit insights

- Joint identity protection

- Shared privacy controls

Family

💵 $32 per month (billed annually) or $65 per month (billed monthly). Best for households with kids—monitor minors’ credit and control data exposure.

- Up to five child profiles

- Family credit health dashboard

- Parental data broker removal

- Full identity restoration

Refresh Is Best For

Whether you’re just starting out or building generational wealth, Refresh caters to a variety of financial journeys.

Young Professionals

Establish credit quickly with daily updates, get spending alerts to stay on budget, and access privacy tools to keep your new online presence secure.

Married Couples

Coordinate joint finances, share insights on each other’s spending patterns, and safeguard both identities under one plan.

Parents and Families

Monitor minor credit, restrict data broker listings for your children, and teach responsible money habits with consolidated dashboards.

Credit Rebuilders

Track your progress with actionable tips, dispute errors swiftly, and get guided strategies to raise your credit score over time.

Benefits of Using Refresh

With Refresh, you gain peace of mind and the tools to take control of your entire financial life:

- Holistic Financial Visibility: See banking, credit, investments, and privacy status in one unified view.

- Proactive Credit Management: Catch errors, monitor inquiries, and follow custom recommendations to boost your score.

- Robust Identity Safeguards: Comprehensive protection and insurance for peace of mind against fraud.

- Automated Privacy Defense: We hunt down and remove your details from data brokers on an ongoing basis.

- Data-Driven Decisions: Use AI-powered insights to optimize spending, payoff debt, and grow investments.

- Time Savings: Consolidate multiple subscriptions—budgeting, credit monitoring, identity protection—into one low-cost plan.

Customer Support

Refresh’s support team is available via live chat, email, and phone. Response times average under five minutes for urgent issues, and detailed follow-up is provided for complex identity or credit disputes.

Members have access to dedicated restoration specialists who will guide you step by step through any identity theft or data breach scenario. The combined expertise of financial advisors and privacy experts ensures you’re never left in the dark.

External Reviews and Ratings

Users praise Refresh for its intuitive interface, thorough credit insights, and hands-on identity protection. Many highlight how easy it is to spot spending trends and catch fraudulent charges before they snowball.

Some feedback points to a learning curve in customizing budget categories and occasional sync delays with smaller regional banks. The Refresh team continuously refines integrations and has rolled out faster sync protocols in response.

Educational Resources and Community

Refresh offers a rich library of resources: weekly blog posts on credit hacks, in-app tutorials for new features, monthly webinars with finance experts, and an active community forum where members share success stories and strategies.

Whether you want to dive into advanced investment allocations or learn how to negotiate lower interest rates, Refresh’s educational hub has you covered from A to Z.

Conclusion

Maintaining a strong credit score and protecting your identity no longer requires juggling multiple services. With Refresh, you get comprehensive credit monitoring, broad financial insights, and automated privacy defense all in one platform. Ready to simplify your financial life? Unlock exclusive savings with Refresh annual plans.