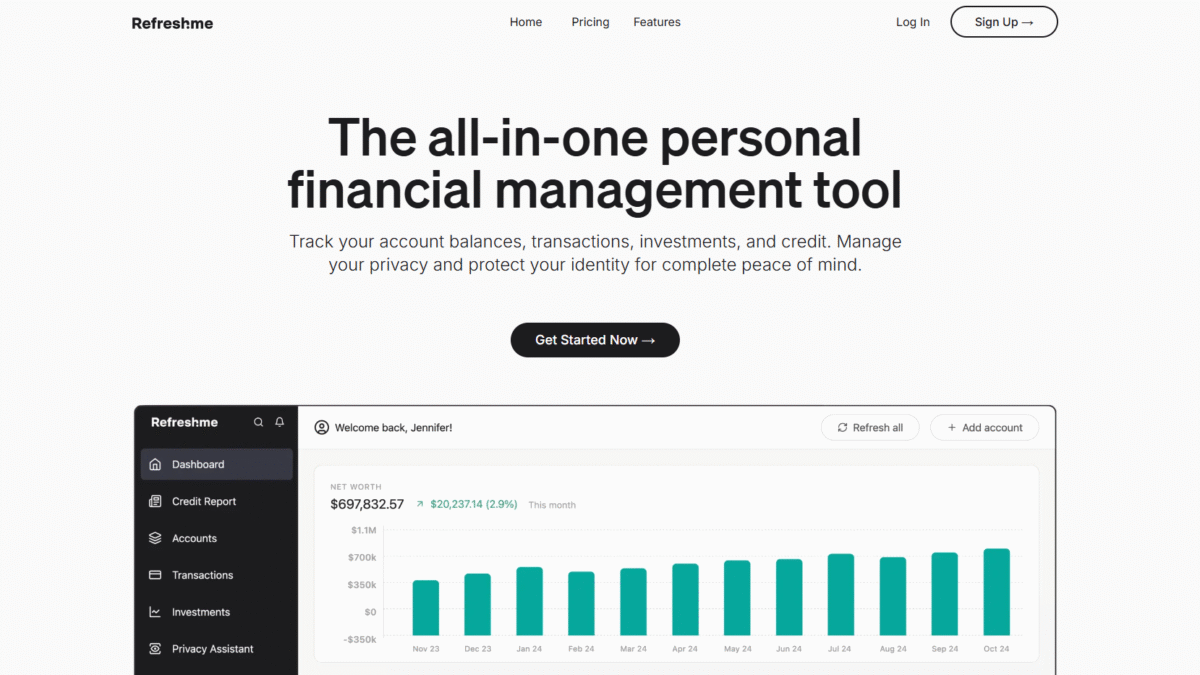

Boost Your Credit Score with Full Financial Insights

Searching for the ultimate guide to credit score? You just landed on the right place… We’ll explore how Refresh can transform your approach to financial health and help you boost your credit rating efficiently.

I know how frustrating it can be to see your credit score lag behind your goals. With years of experience helping individuals and families, Refresh has earned trust for delivering accurate insights, robust privacy management, and powerful identity theft protection. Right now, you can Get 40% OFF Refresh annual plans Today and start elevating your credit performance.

What is Refresh?

Refresh is an all-in-one personal financial management tool built around giving you full visibility into your accounts, transactions, investments, and your credit score. By syncing with over 12,000 banks and institutions, Refresh creates a single dashboard where you can monitor every aspect of your financial life. Beyond budgeting and investment tracking, Refresh integrates real-time credit report and score updates, identity theft protection, and proactive privacy management to secure your personal data across the web.

Refresh Overview

Founded by seasoned fintech entrepreneurs, Refresh set out to simplify complex financial tracking and provide actionable intelligence that helps you grow and protect your net worth. Today, Refresh has served millions of users, secured partnerships with major banks, and won awards for innovation in personal finance technology.

The mission of Refresh is to empower you with a clear view of your entire financial landscape. Whether you’re aiming to improve your credit score, optimize your spending, or safeguard your identity, Refresh delivers superpowered insights you won’t find anywhere else.

Pros and Cons of Refresh for Your credit score

Pros:

Comprehensive Credit Monitoring: Refresh pulls data from all three credit bureaus—TransUnion, Experian, and Equifax—so you get a 360-degree view of your credit situation.

Daily Score Updates: Stay informed with real-time alerts when inquiries are made or changes occur in your credit report.

Identity Theft Protection: $1 million insurance coverage and white-glove restoration services in case of fraud.

Privacy Management: Refresh actively scans data broker sites and removes your personal details to reduce risks.

All-in-One Dashboard: View account balances, transactions, investments, and credit metrics in a single, intuitive interface.

AI Assistant: Personalized financial guidance helps you make smarter decisions about credit utilization and debt reduction.

Affordable Annual Plans: With Get 40% OFF Refresh annual plans Today, accessing premium features has never been more cost-effective.

Customizable Alerts: Configure spending notifications, upcoming payment reminders, and credit limit changes to stay on track.

Educational Content: In-app resources and tips help you understand factors impacting your credit score and how to address them.

Bank-Level Security: Multi-factor authentication and encryption ensure your data stays safe.

Cons:

Monthly subscription fees may not fit every budget, though annual discounts mitigate costs for long-term users.

Certain niche financial institutions might not be supported yet, but Refresh rapidly adds new integrations based on user demand.

Features to Improve Your credit score

Refresh’s features are designed to target the key drivers of your credit performance. By consolidating insights into one platform, you can take impactful steps toward raising your score.

Credit Report and Score

Access your complete credit report from Equifax each month, along with updates from all three bureaus:

- Full breakdown of accounts, balances, and payment history

- Soft and hard inquiry tracking

- Custom alerts for new accounts or significant balance changes

Identity Theft Protection

Comprehensive coverage includes:

- $1 million insurance for fraud resolution costs

- Dedicated case specialists for white-glove restoration

- Early-warning alerts for suspicious account activity

Privacy Management

Stop data brokers from selling your personal information:

- Automated scans of major broker sites

- Data removal requests on your behalf

- Ongoing monitoring for reappearances

Spending and Budget Tracking

Understand how your habits impact your credit:

- Transaction categorization for clear spending breakdowns

- Overspending alerts to avoid high utilization

- Custom budget goals tied to credit improvement strategies

Investment Tracking

View all investment holdings alongside your credit metrics:

- Portfolio performance over time

- Allocation analysis to maintain diversified risk

- Integration with major brokerages and retirement accounts

AI Assistant

Receive personalized insights and recommendations:

- Credit-building tips like optimal account mix

- Debt payoff strategies to lower utilization

- Savings recommendations to bolster emergency funds

Refresh Pricing

Whether you’re a solo user or managing a family’s finances, Refresh has a plan that fits your needs and budget.

Individual

Price: $12 per month billed annually or $20/month billed monthly

- Ideal for single professionals who want robust credit monitoring

- Includes 3-bureau updates, AI Assistant, identity protection, and privacy management

Couple

Price: $22 per month billed annually or $35/month billed monthly

- Perfect for partners building credit together

- Shared dashboard, joint alerts, full feature set

Family

Price: $32 per month billed annually or $65/month billed monthly

- Designed for families with children or dependents

- Additional profiles, parental controls, comprehensive coverage

Refresh Is Best For

Refresh excels at serving diverse audiences who share one goal: improving their credit score and overall financial health.

Credit Builders

If you’re new to credit or recovering from past missteps, Refresh guides you through smart account management, credit utilization optimization, and timely payment reminders.

Busy Professionals

Juggling multiple accounts and investments? Refresh consolidates everything—transactions, account balances, and credit metrics—to save you time and effort.

Families

Protect your loved ones with identity theft coverage, privacy management for every household member, and kid-friendly financial education resources.

Active Investors

Monitor your portfolio’s performance alongside your credit health to ensure your financial strategy is balanced and resilient.

Benefits of Using Refresh for a Better credit score

- Real-Time Credit Insights: Spot issues early and act before they damage your rating.

- Identity Protection: Reduce your risk of fraud with proactive monitoring and restoration support.

- Privacy Management: Keep personal data off broker sites to minimize exposure.

- Holistic Financial View: Combine spending, savings, investments, and credit in one dashboard.

- Actionable Alerts: Receive notifications that prompt you to pay down balances or dispute errors.

- Expert Guidance: Use the AI Assistant for tailored credit-building strategies.

- Peace of Mind: Know your finances and reputation are shielded under bank-level security.

Customer Support

Refresh’s support team responds quickly via in-app chat and email to answer any questions about account syncing, credit alerts, or identity concerns.

Whether you need help disputing a report entry or managing your privacy settings, Refresh offers clear, knowledgeable guidance to resolve your issues without hassle.

External Reviews and Ratings for Refresh credit score features

Users consistently praise Refresh for its intuitive interface and comprehensive credit monitoring. Many share success stories of seeing their scores rise by dozens of points after following tailored recommendations.

Some feedback notes occasional delays in adding new bank connections, a challenge that Refresh addresses with regular integration updates and rapid customer feedback loops.

Educational Resources and Community

Refresh provides a wealth of learning materials, including blog articles on credit management, step-by-step tutorials on identity restoration, webinars with financial experts, and an active community forum where members share tips for boosting their credit score.

Conclusion

Improving your credit score and guarding your financial future has never been more straightforward. With Refresh, you get a unified dashboard for all your accounts, real-time insights to address credit risks, and premium privacy and identity protection features.

Ready to take control and see measurable improvements? Get 40% OFF Refresh annual plans Today and start building a stronger financial foundation.