Revamp Your Personal Finance & Save 40% on All-in-One Tool

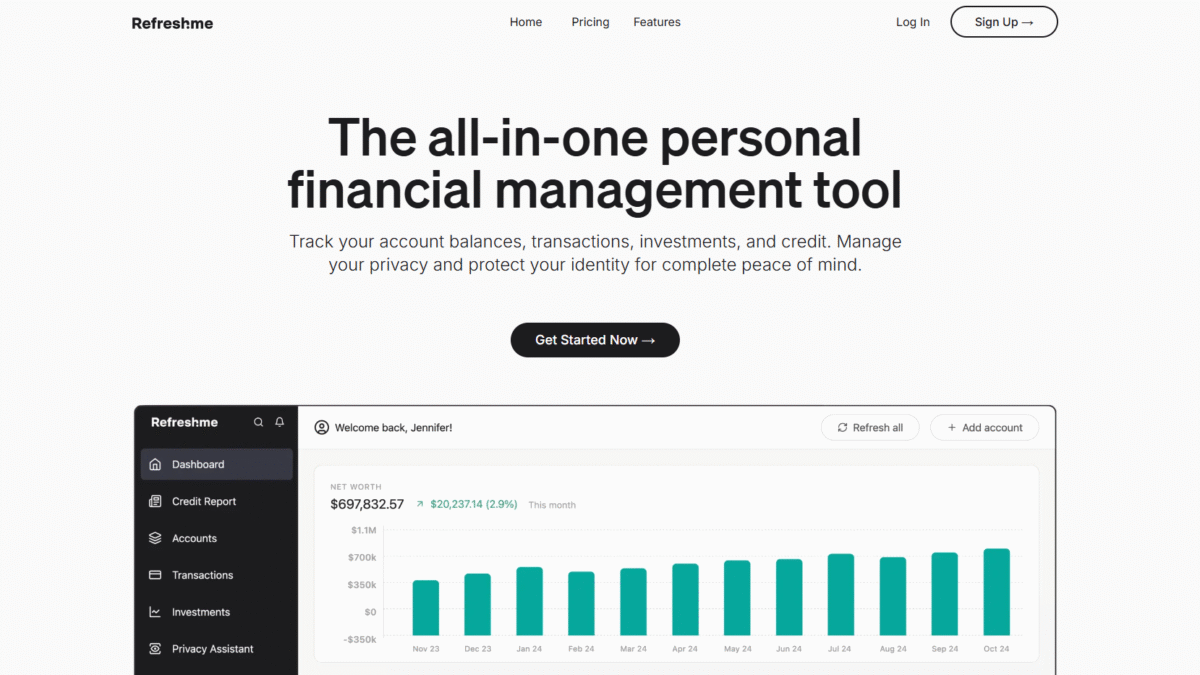

Searching for the ultimate guide to personal finance? You just landed on the right page. As someone who’s navigated every budgeting app and investment tracker under the sun, I know how overwhelming it can be to pull your financial life into focus. That’s why I rely on Refresh—the all-in-one tool that brings together budgeting, investments, credit monitoring, and identity protection in one unified dashboard.

Managing your money shouldn’t require logging into a dozen different platforms. With over a decade of experience and endorsements from thousands of users, Refresh streamlines your digital financial life. And right now, you can Get 40% OFF Refresh annual plans Today to supercharge your personal finance journey.

What is Refresh?

Refresh is a comprehensive personal financial management platform designed to consolidate every aspect of your financial life in one secure space. From checking and savings accounts to credit reports and investment portfolios, Refresh provides a real-time overview that empowers you to make smarter decisions and stay on track with your goals.

Refresh Overview

Founded by a team of fintech experts and consumer advocates, Refresh set out with a clear mission: to simplify personal finance management through intuitive design and cutting-edge technology. Since launching, Refresh has grown to integrate with over 12,000 banks and institutions, delivering instant access to account balances, transaction tracking, and credit insights.

Along the way, Refresh has earned industry accolades for its robust security measures, user-friendly interface, and AI-driven insights. Whether you’re an individual, a couple, or managing a family’s finances, Refresh adapts to your needs with scalable plans and white-glove support.

Pros and Cons

Pros:

Unified Dashboard: See all your bank accounts, investments, and credit scores in one place for a complete picture.

12,000+ Integrations: Connect virtually any financial institution—no more manual imports.

Real-Time Spending Alerts: Get notified if your outflows spike, helping you stay disciplined.

3-Bureau Credit Monitoring: Daily updates from TransUnion, Experian, and Equifax to catch issues before they escalate.

Identity Theft Protection: Includes $1 million in coverage plus white-glove restoration services.

AI Financial Assistant: Personalized recommendations to optimize your budget and investments.

Cons:

Learning Curve: Feature-rich interface can feel overwhelming at first.

Annual Billing Requirement: Best rates require upfront annual payment, which may be steep initially.

Features

Refresh packs a suite of powerful features to elevate your personal finance management. Here’s a closer look at what makes it stand out:

Account Aggregation

Sync all of your bank accounts, credit cards, loans, and investment accounts in one secure hub.

- Over 12,000 supported financial institutions

- Automatic balance updates and transaction imports

- Customizable account labeling for clarity

Spending Insights

Visualize your spending patterns with categorized transaction breakdowns.

- Weekly and monthly trend charts

- Alerts for unusual spending spikes

- Goal-setting tools to curb overspending

Investment Tracking

Monitor your entire portfolio—stocks, bonds, mutual funds, and more—without juggling multiple apps.

- Historical performance charts

- Allocation analysis by asset class

- Dividend and interest tracking

Credit Reports & Scores

Access monthly Equifax credit reports and daily three-bureau score updates.

- Alerts for new inquiries or accounts

- Credit improvement tips

- Detailed credit history breakdown

Identity Theft Protection

Comprehensive monitoring and restoration to safeguard your identity.

- $1 million insurance coverage

- White-glove restoration assistance

- 24/7 support hotline

Privacy Management

Stop data brokers from selling your personal information online.

- Proactive data removal requests

- Continuous monitoring of broker sites

- Real-time notifications of data broker activity

Refresh Pricing

Refresh offers flexible pricing tiers designed for different household sizes—all include the full suite of features.

Individual Plan

Price: $12 per month (billed annually) or $20 per month (monthly billing)

Ideal for solo users wanting full financial visibility and protection.

Highlights:

- Monthly credit report & score

- AI Assistant guidance

- 3-bureau updates

- Identity & privacy protection

Couple Plan

Price: $22 per month (billed annually) or $35 per month (monthly billing)

Perfect for partners merging finances and coordinating goals.

Highlights:

- All individual features for two users

- Shared budgeting tools

- Joint alerts & notifications

Family Plan

Price: $32 per month (billed annually) or $65 per month (monthly billing)

Designed for families needing multiple profiles under one account.

Highlights:

- All couple features plus child monitoring

- Customizable permissions for each member

- Family-wide identity protection

Refresh Is Best For

Whether you’re just starting out or managing a complex financial ecosystem, Refresh adapts to your needs.

Budget-Conscious Individuals

Track every dollar, curb impulse spending, and reach savings milestones faster.

Couples Managing Money Together

Share budgets, set joint goals, and stay in sync on bills without Phil chasing Brenda for receipts.

Families With Multiple Accounts

Keep an eye on everyone’s spending, guard kids’ identities, and simplify household finances.

Investors Wanting Consolidation

See the big picture—check stocks, funds, and retirement accounts in one unified portfolio.

Benefits of Using Refresh

- Time Savings: No more logging into dozens of apps—everything’s in one place.

- Enhanced Security: Military-grade encryption and 24/7 identity monitoring.

- Smarter Decisions: AI-driven insights help you optimize budgets and investments.

- Credit Confidence: Stay ahead of issues with daily three-bureau updates and alerts.

- Privacy Peace of Mind: Continuous data broker removal keeps your personal info off the open market.

Customer Support

Refresh offers responsive customer service through live chat, email, and phone support. Agents are available 24/7 to answer questions about setup, troubleshooting connections, or identity restoration steps.

Whether you need guidance on reading your credit report or assistance filing an identity theft claim, Refresh’s dedicated support team delivers white-glove treatment to resolve issues quickly and keep you moving forward.

External Reviews and Ratings

Users consistently praise Refresh for its intuitive interface and comprehensive feature set. Many highlight the convenience of viewing budgets, credit scores, and investments together—something no competing app offers as seamlessly.

On the flip side, a small number of users mention a learning curve when first exploring advanced features. Refresh addresses this with detailed tutorials and an AI Assistant that walks you through every step, ensuring you get the most out of the platform.

Educational Resources and Community

Refresh goes beyond software by offering a rich library of educational materials. The official blog covers topics from debt reduction strategies to optimizing investment allocation. Monthly webinars and interactive tutorials help you deepen your financial knowledge.

Plus, the Refresh community forum connects you with fellow users to swap tips, ask questions, and share success stories. It’s a collaborative space where you can learn real-world money management techniques and cheer each other on.

Conclusion

Your journey to mastering personal finance starts with clarity and the right tools. With Refresh, you get a unified dashboard for budgets, investments, credit scores, and identity protection—all backed by top-tier security and expert support. Don’t settle for piecemeal solutions that leave gaps in your financial strategy.

Get 40% OFF Refresh annual plans Today and take control of your financial future with confidence!