Flash Sale: Up to $5000 Instant Cash Loans with Lenme

Hunting for the ultimate flash sale deal on Lenme? You’re in the perfect spot. I’ve dug deep to secure the very best Get Access to up to $5000 Instant Cash Today offer that you won’t stumble upon anywhere else. Rest assured, this exclusive deal delivers maximum value—no catch, no fine print, just instant access to the funds you need at a rate that makes sense.

I’m excited to walk you through every angle of what makes Lenme stand out in today’s crowded lending landscape. You’ll discover how this platform leverages cutting-edge technology to slash traditional costs, deliver transparent terms, and connect you with lenders who compete for your business. Stay tuned—you’ll soon see why this limited-time flash sale could be the smarter way to borrow up to $5,000 in minutes.

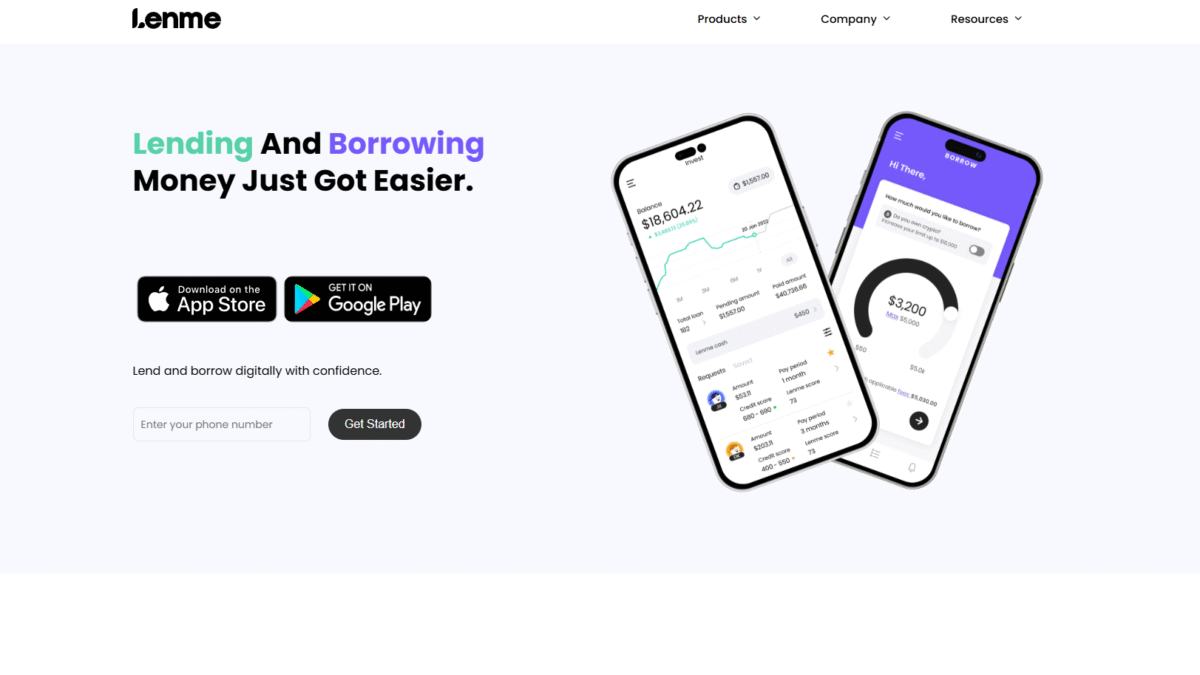

What Is Lenme?

Lenme is a peer-to-peer lending marketplace designed to bring transparency, efficiency, and affordability to personal borrowing. Instead of dealing with banks or credit unions burdened by high overhead, Lenme connects you directly with private lenders through a sleek app interface. It addresses two major pain points:

- Borrowers facing steep fees, slow approvals, and rigid credit requirements.

- Lenders struggling with operational costs, borrower verification, and loan servicing.

By partnering with the most trusted credit bureaus, Lenme verifies each borrower’s identity, income, and credit score in real time. The result? Instant visibility into borrower risk, lower administrative expenses, and a competitive marketplace that drives down interest rates for you.

Features

Lenme’s feature set is engineered to simplify every step of the borrowing and lending journey. From rapid identity checks to a transparent bidding process, here’s a detailed look at what sets it apart.

Identity and Credit Verification

This is the foundation of Lenme’s secure environment. Through industry-leading services, the platform authenticates every borrower before they request a loan.

– Real-time checks with Equifax, Experian, and TransUnion

– Automated income verification via payroll integrations

– Fraud detection tools to flag suspicious applications

Transparent Competitive Bidding

Rather than pre-set interest tiers, Lenme invites multiple lenders to offer bids on your loan request. You see each rate side by side and choose the one that best fits your budget.

– Compete to save: lenders vie to deliver the lowest rate

– Clear breakdown of APR, fees, and repayment schedule

– No hidden charges—what you see is exactly what you pay

Instant Funding

Once you accept an offer, the cash is typically in your bank account within minutes. Gone are the days of waiting days or weeks for approval.

– Seamless ACH transfers directly to your checking account

– Minimal documentation—just a few clicks and you’re done

– 24/7 access: submit requests anytime, day or night

Flexible Loan Amounts

Whether you need a small bridge loan or a more substantial amount for an unexpected expense, Lenme covers you.

– Borrow anywhere from $50 to $5,000 in a single request

– Adjustable terms from 3 to 12 months

– Early payoff options with no prepayment penalties

Investor Dashboard

For those looking to put their capital to work, Lenme offers an intuitive dashboard that brings the power of big-bank analytics to your fingertips.

– Access to over 2,000 data points per borrower

– Automated payment tracking, collection, and reporting

– Diversification tools to spread risk across multiple loans

Pricing

Lenme keeps pricing straightforward—no subscription fees, no surprise service charges. Instead, borrowers pay an interest rate determined by lender competition.

- Starter Loan: Ideal for borrowing $50–$500. Rates start from 10% APR. Includes basic identity and credit checks.

- Standard Loan: Best for $500–$2,000 needs. Rates typically range from 8% to 15% APR. Comes with faster funding options.

- Premium Loan: For amounts $2,000–$5,000. Competitive rates begin at 6% APR. Includes priority support and flexible terms up to 12 months.

If you’re only looking for a small advance, the Starter Loan’s low barrier makes it perfect. Need more funds? The Premium Loan tier offers substantial improvements in rate and term flexibility. And remember, you’ll always see the best available competing offers.

Benefits to the User (Value for Money)

Lenme delivers genuine value for money through its innovative approach. Here are the top benefits I’ve experienced and observed:

- Lower Interest Rates

By eliminating traditional overhead, Lenme passes savings directly to borrowers in the form of reduced APRs. - Fast Approval and Funding

No more waiting days—lenme’s automated processes mean you’ll often have cash in minutes. - Transparent Terms

All fees, rates, and schedules are laid out before you commit, so there are no surprises at repayment time. - Wide Range of Loan Amounts

Flexibility to borrow as little as $50 or as much as $5,000 based on your needs. - No Prepayment Penalties

Pay off your loan early without incurring extra fees, saving you even more in interest. - Competitive Bidding

Watch lenders compete for your business, driving down rates and giving you better control. - Robust Security

Industry-standard encryption and verification ensure your personal data stays secure at all times. - Accessible Customer Support

Dedicated teams stand ready to assist through multiple channels whenever you have questions. - Investor Opportunities

For those seeking returns, the platform gives you tools rivaling large financial institutions. - Mobile Convenience

Borrow or invest directly from your smartphone with a few taps, anytime, anywhere.

Customer Support

I’ve found Lenme’s support team impressively responsive. If you have a question about your application or need help with repayments, you can reach out via email or live chat right within the app. Most inquiries receive a reply within one business hour, and the support staff demonstrate clear product knowledge and genuine commitment to resolving issues.

For more urgent matters, Lenme offers phone support during extended business hours, ensuring you’re never left hanging. They also maintain a detailed help center and FAQ section, so many common questions can be answered instantly without waiting for a representative.

External Reviews and Ratings

Lenme has garnered positive feedback across multiple reputable review sites:

- Trustpilot: Average rating of 4.5/5 stars, with users praising quick approvals and competitive rates.

- Google Play Store: 4.4/5 stars from over 2,000 reviews, highlighting the ease of use and transparent bidding process.

- App Store: 4.3/5 stars based on lender-borrower satisfaction surveys.

Some users have noted occasional delays during peak application times and suggested expanding customer support hours. Lenme is already addressing these points with plans to hire additional support staff and optimize server capacity, according to their public roadmap.

Educational Resources and Community

Lenme isn’t just a lending platform—it’s also a knowledge hub. Their official blog covers personal finance, budgeting tips, and debt management strategies. Video tutorials walk you step-by-step through the application process, while in-depth articles explain how peer-to-peer lending works and ways to optimize your borrower profile.

On top of that, Lenme hosts an active user forum and a private Facebook community where borrowers share experiences and tips. Investors can join webinars led by financial experts to learn portfolio diversification and risk mitigation strategies. All these resources help you make informed decisions whether you’re borrowing or lending.

Conclusion

By now, it’s clear why Lenme stands out as a top choice for anyone seeking fast, affordable, and transparent personal loans during this flash sale. With competitive bidding, instant funding, and zero hidden fees, Lenme delivers exceptional value that traditional lenders simply can’t match.

Ready to unlock up to $5,000 in minutes? Don’t miss out on this exclusive Get Access to up to $5000 Instant Cash Today offer. Click the link below and experience a smarter way to borrow—before this flash sale ends!